Free Transfer-on-Death Deed Document for the State of Kansas

The Kansas Transfer-on-Death Deed form serves as a valuable tool for property owners seeking to streamline the transfer of their real estate upon death. This legal document allows individuals to designate beneficiaries who will inherit their property without the need for probate, thereby simplifying the transfer process and potentially saving time and money. Importantly, the form must be properly executed and recorded to be effective, ensuring that the wishes of the property owner are honored. It is crucial to understand the specific requirements for completing the deed, including the need for signatures and notarization. Additionally, the Kansas Transfer-on-Death Deed can be revoked or amended at any time during the owner's lifetime, providing flexibility and control over the estate planning process. As property owners navigate their options, this deed stands out as an efficient way to facilitate the transfer of real estate, while also allowing for clear communication of intentions to heirs.

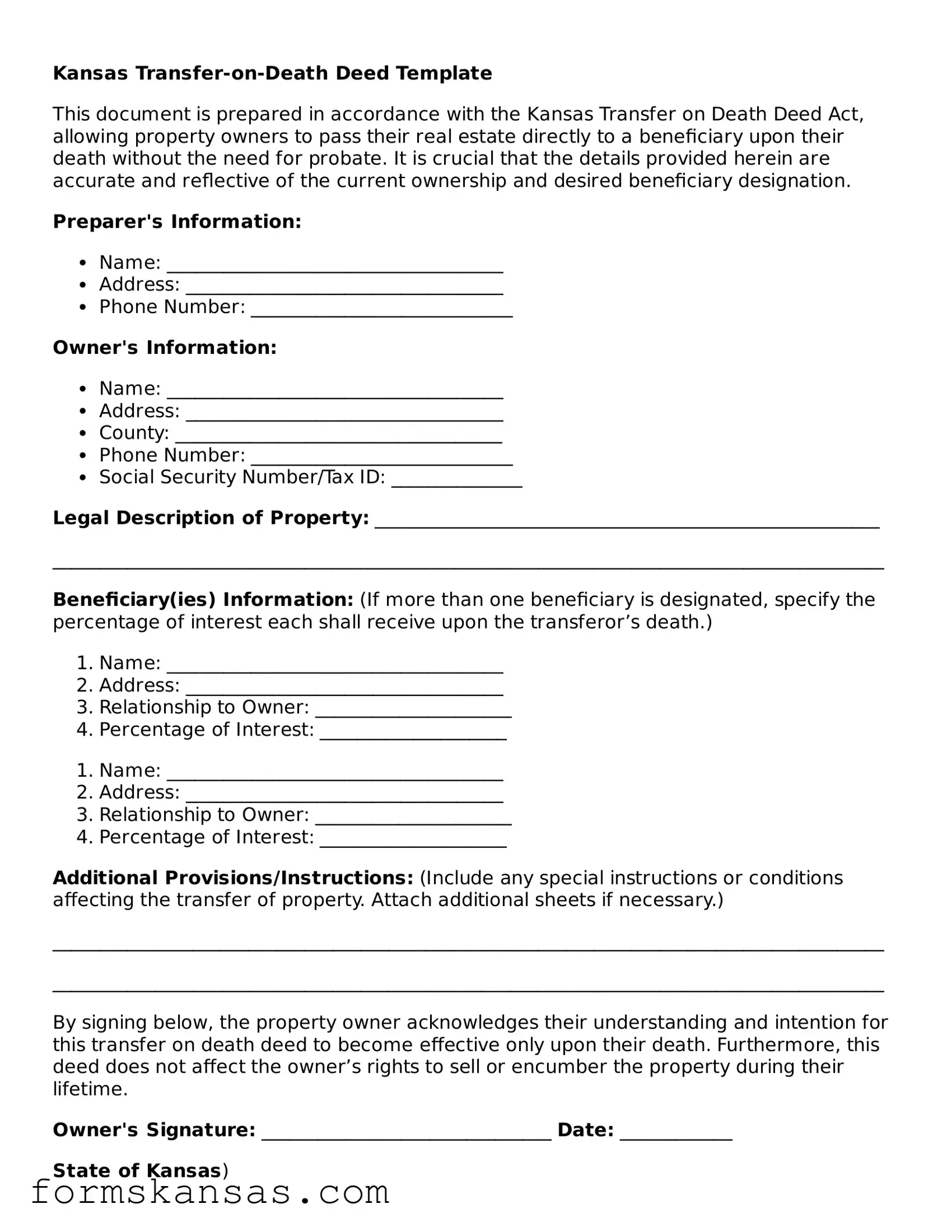

Document Sample

Kansas Transfer-on-Death Deed Template

This document is prepared in accordance with the Kansas Transfer on Death Deed Act, allowing property owners to pass their real estate directly to a beneficiary upon their death without the need for probate. It is crucial that the details provided herein are accurate and reflective of the current ownership and desired beneficiary designation.

Preparer's Information:

- Name: ____________________________________

- Address: __________________________________

- Phone Number: ____________________________

Owner's Information:

- Name: ____________________________________

- Address: __________________________________

- County: ___________________________________

- Phone Number: ____________________________

- Social Security Number/Tax ID: ______________

Legal Description of Property: ______________________________________________________

_________________________________________________________________________________________

Beneficiary(ies) Information: (If more than one beneficiary is designated, specify the percentage of interest each shall receive upon the transferor’s death.)

- Name: ____________________________________

- Address: __________________________________

- Relationship to Owner: _____________________

- Percentage of Interest: ____________________

- Name: ____________________________________

- Address: __________________________________

- Relationship to Owner: _____________________

- Percentage of Interest: ____________________

Additional Provisions/Instructions: (Include any special instructions or conditions affecting the transfer of property. Attach additional sheets if necessary.)

_________________________________________________________________________________________

_________________________________________________________________________________________

By signing below, the property owner acknowledges their understanding and intention for this transfer on death deed to become effective only upon their death. Furthermore, this deed does not affect the owner’s rights to sell or encumber the property during their lifetime.

Owner's Signature: _______________________________ Date: ____________

State of Kansas)

County of _______________)

Subscribed and acknowledged before me on this ___ day of ____________, 20__, by __________________________________, Owner of the property described herein.

Notary Public: _________________________________

My Commission Expires: _______________________

This document must be duly recorded with the county recorder of deeds where the property is located to be effective.

Form Features

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TODD) allows property owners in Kansas to transfer real estate to beneficiaries upon their death, without going through probate. |

| Governing Law | The Kansas Transfer-on-Death Deed is governed by K.S.A. 58-6a, which outlines the requirements and procedures for creating and executing the deed. |

| Eligibility | Any individual who owns real estate in Kansas can create a TODD, provided they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed, and they can also specify alternate beneficiaries in case the primary ones are unable to inherit. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, as long as they follow the proper procedures outlined in Kansas law. |

| Filing Requirements | The deed must be signed by the property owner and notarized. It must then be recorded with the county register of deeds to be effective. |

| Tax Implications | There are generally no immediate tax implications for the property owner when creating a TODD. However, beneficiaries may face tax obligations upon inheriting the property. |

| Limitations | A TODD cannot be used for all types of property. For example, it cannot transfer personal property, such as vehicles or bank accounts, only real estate. |

Other Popular Kansas Templates

How to Write a Bill of Sale for a Car in Kansas - The precision and specificity of a Bill of Sale prevent misunderstandings or disputes between the parties involved.

To effectively safeguard your sensitive information, consider utilizing the Non-disclosure Agreement form available at this essential Non-disclosure Agreement template. It offers a structured approach to managing confidentiality and sets clear expectations for all parties involved.

Home Schooling in Kansas - The Homeschool Letter of Intent is a requisite form signaling to educational administrators a family's commitment to a home education curriculum.